Part 1

You Need a People Strategy

Perhaps no other sector has seen as much upheaval during COVID-19 than Financial Services (FS). Already subject to unpredictable market shifts and externalities, the past year has brought on even more uncertainty over workforce stability, economic recovery and growth, and the future of investments. While FS organizations look for ways to adapt to changes and respond to emerging challenges, it’s imperative that your strategic planning cover people resources. A PwC survey of CEOs reports that Financial Services CEOs “cite human capital as the second most important area they need to strengthen to capitalize on growth opportunities, behind only digital and technological capabilities.” 1

Without a clear people strategy and systematic management of people resources, organizations are both losing opportunity and tolerating avoidable risks. Digital transformation and the new gig economy are only a few compelling reasons for organizations to develop and maintain their people strategies. “Failing to bring people strategies up to speed can only heighten the risk of skills gaps and falling behind more agile and farsighted competitors.

“Organizations with effective performance management are 77 percent more likely to outperform competitors and peers.”3

If, however, companies implement a people strategy that begins with enhanced organization-wide transparency into all resources and work, they will be far better equipped to react to disruption, forecast resource needs, optimize workflows, and ultimately “re-engage, innovate, and differentiate, not just in traditional areas, but through new business models, [becoming] powerful magnets for human, financial, and emotional capital.4

The following paper examines three major drivers of the talent wars across Financial Services sectors in recent years, many exacerbated by COVID-19. With a scarce and volatile workforce, companies are perpetually vying for talent, yet most have neither a clear plan to attract people nor the resource structures in place to cultivate and fully leverage them. The underlying causes of talent scarcity explored in this paper can be addressed with industry-proven people management approaches and techniques, most of which can be implemented and scaled rather quickly with the right tools and commitments.

“…the ROI for businesses that get talent right is 2.5 times greater in the first year after a transformation.”5

Tempus Resource provides the tools and capabilities to gain organization-wide transparency into skills, competencies, and capacities. Use Tempus’s unique combination of capabilities to not only gain insight, react to uncertainty, and conduct capacity planning, but also to craft strategies for workforce development.

Try Tempus today for free with your data!

Part 2

Talent Scarcity in a Hyper-Competitive Market

The talent shortage in Financial Services can be attributed to several causes. Among the most pressing is competition with Big Tech for the same skills and experiences, creating a fierce talent war in the midst of global digital transformation. FS organizations are not only seeking financial talent, but also tech specialists as many FS operations are undergoing automations, shifts to remote work, and the need to offer digital customer services via desktop and mobile apps. Critical FS roles are now “in software and application development (e.g., scrum master), analytics (e.g., data scientists), new risk management roles (e.g., cybersecurity analysts), and digital marketing (e.g., UX designer).”6 Delivering better customer experiences therefore requires “the same talent needed by the technology sector…and competing with the likes of Apple and Google.”7

But Big Tech holds some major advantages in attracting and retaining talent, including their brand, “more flexible schedules, better benefits, improved work environments, and even relaxed dress codes.” For those organizations who seek a competitive edge against the tech giants, it will take “emphasis on employee attraction, management, development, and retention.”9

These components of a larger people strategy aren’t just beneficial to employees. A people strategy is, in fact, crucial to business flexibility and success. People resource management needs to be “more nimble than ever to respond to constantly changing internal and external pressures. These pressures challenge their ability to achieve operational excellence, improve workforce effectiveness, develop future leaders, and capitalize on the growth of emerging markets.”10

Resource Management that Takes Care of People’s Time

Businesses compete for talent by offering perks like unlimited PTO, flexible office hours, remote work, and other “time benefits.” But these all place the burden of action on the employee, and “there is now strong evidence that many employees don’t take advantage of such a benefit and may not take any time off at all. This can sometimes happen due to management or leadership perceptions.”

These kinds of time perks also fail to address whether actual work hours are optimized or sustainable. Resource management must be about more than a few extra hours to recover from overwork; it should ensure that work is done with balance and without burnout.

“Once a laser-focus on talent from the top team has been achieved, leaders must link business value to the most critical roles. Not just looking at current needs, but also focusing on the delivery of future value. Do you know where the real value-creating roles are in your organization?”12

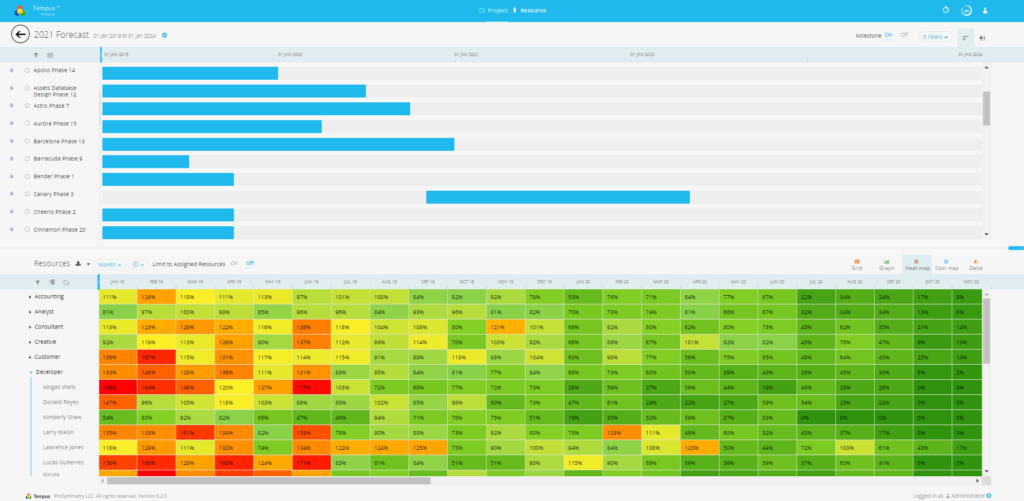

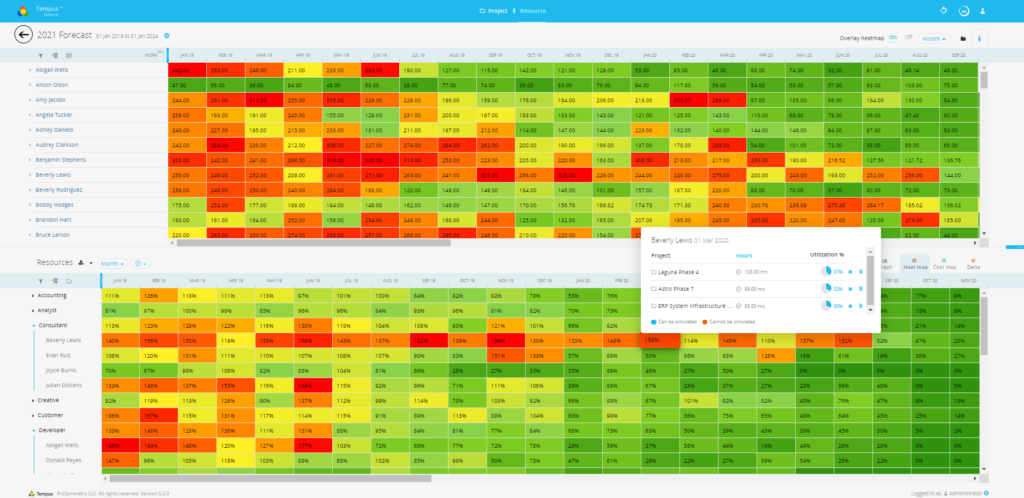

Essentially, managers and employees alike should have complete visibility into their capacity: how many projects is an individual assigned to? How much of their time is allocated to each project? How much time is actually spent on each project? What are the project interdependencies, constraints, and potential impact factors (delays, budget issues, sick leave or personal time, etc.)? As soon as over-capacity is detected, managers must act to adjust commitments and maintain healthy allocations for everyone.

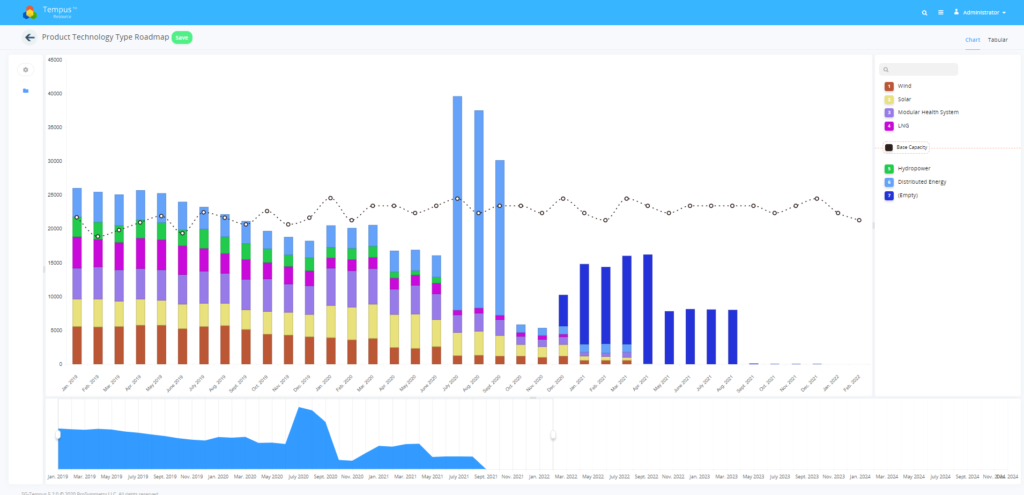

Ideally, this kind of capacity data should flow into a reporting function that can render insights visually, in addition to being easy to update and keep accurate. If Financial Services is going to compete with Big Tech for the best people, they must offer the best places for people to spend their time.

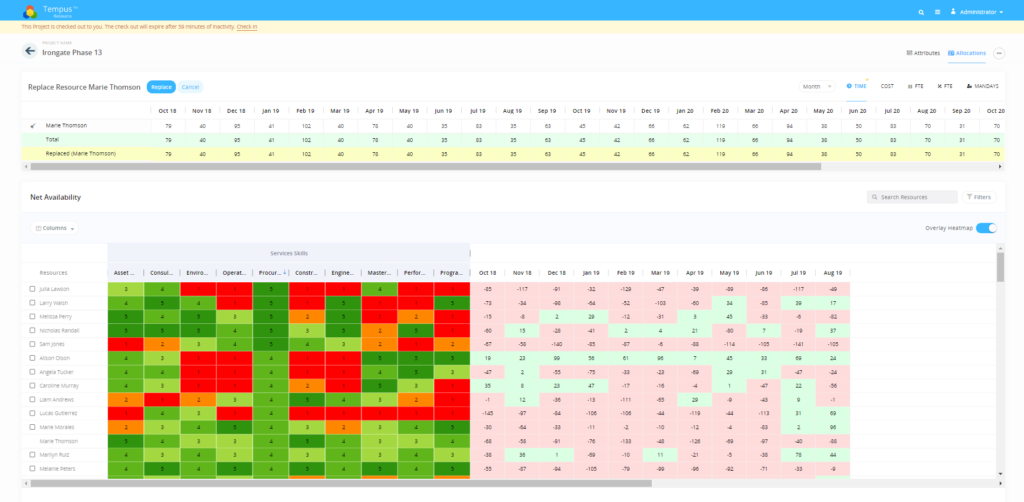

Tempus Resource includes easy to use purpose-built report writers—enabling you to quickly and easily identify bottlenecks and visualize cross project allocations—as well as heatmaps and supply-demand analytics to visualize over and under allocations. Further benefits include Tempus’s ability to capture and compare actual time against planned or forecasted time and identify how effectively or ineffectively your organization plans and utilizes scarce and expense resources.

Try Tempus today for free with your data!

Part 3

A Shifting and Uncertain Financial Workforce

Both the global shift toward remote work and the gig economy have impacted Financial Services along with most other sectors. Also called the “Open Talent Economy,” this ever-growing base of independent contractors are the “contingent workforce that allows organizations to greatly increase the flexibility and responsiveness of their workforce…and flexibility to scale up and down their workforce to meet demand and deliver innovative projects without tying up internal resources.”13

“The financial services sector now has an unprecedented focus on change, agility and adaptation to new innovations.”14

30% of insurance companies surveyed are “already using talent marketplaces.” And while 62% of insurance executives surveyed “planned to increase their contingent workforce over the next year,” that number was even higher in banking, where “freelance contractors are expected to increase more than 51% over the next year.”15 One key reason for the attraction is speed of hire: it takes on average less than 3 days to hire a freelancer, as opposed to the average of 34 days using traditional recruiting and hiring methods.16 The resulting cost savings can add up to millions on training, equipment, benefits, and more.17

Major workforce shifts have also been caused by ongoing mergers and acquisitions across Financial Services. From Bank of America-Merrill Lynch and Citigroup-Wachovia over a decade ago, to Valley National-USAmeriBank in 2018, and the still pending takeover of TD Ameritrade by Charles Schwab, these major realignments might be seeking to consolidate operations and find cost savings,18 but the moves inevitably cause workforce disruptions, leakage, and knowledge loss. Even without external pressures or condition changes, 64% of Asset and Wealth Management CEOs are likely to increase headcount, while over 20% of CEOS in Insurance and Banking and Capital Markets are likely to decrease theirs.19

Resource Management for People, Skills, Competencies, and Scenarios

The point of resource management is not to prevent external changes, but to handle them with the kind of flexibility that can be achieved through a clear people strategy. Externalities cannot be predicted or avoided, but when they occur, organizations can be optimally prepared.

“A slow and uncertain response to today’s talent demands will leave organizations on the back foot – facing growing skills gaps, swathes of people doing work that’s been rendered redundant or operating from the wrong place in the wrong way when competitors have already moved on.”20

One preparation includes maintaining a detailed and up-to-date skills and competencies management system to prevent damaging skills gaps, redundant work, or misaligning talent with critical work. Skills and competencies management is imperative to building teams with balanced expertise, being able to replace resources quickly, and tracking skill deficits to inform and support well-timed and competitive recruiting and hiring initiatives.

Another highly beneficial practice to stay ahead of major workforce shifts is scenario planning, especially when it can be done with an organization’s actual data. The ability to foresee different versions of resource constraints, shortages, overages, or conflicts, based on various potential scenarios, can provide a much-needed edge in business planning. Executives should be able ask, what if we lost 30 people in the upcoming acquisition? What if we lost 50 or 100? Scenario planning has the power to show you exactly where to expect the impact, what would remain viable and what would not, and how to make sound decisions while navigating major changes.

While highly beneficial in many ways, utilizing an independent workforce and contending with mergers and acquisitions also makes for rather volatile workforce dynamics, and people resource managers need a clear strategy to handle such shifts, maintain productivity and profitability, and stay ahead of the next change on the horizon.

Use Tempus Resource and its scenario planning and what-if analysis engine to show you where to expect the impact of externalities on your resource and project portfolio. Use Tempus to make sound decisions while navigating major changes.

With Tempus, you can be optimally prepared to address the challenges of externalities. Use your data to simulate resource constraints, shortages, overages, and conflicts. Model various potential scenarios without altering your live data. Use Tempus’s what-if analytics to craft a much-needed edge in your business planning.

Import your data today and test Tempus’ what-if analysis capabilities.

Part 4

Improving People Decisions with Data

The digital transformation may pose its own challenges for financial services organizations, but it also offers a wealth of data never before so accessible or abundant. Unfortunately, not many companies are taking full advantage of this opportunity. Surprisingly, fewer “than half use data analytics to find, develop and keep people (48%),21 are considering the impact of artificial intelligence on future skills needs (41%) or are exploring the benefits of humans and machines working together (49%),” even though PwC reports that using data analytics for their people strategy would “improve their ability to anticipate changing circumstances and respond proactively.”22

“Over 70% of industry leaders believe that how their organizations manage data will differentiate them.”23

Data itself does not enhance decision making; data must be systematically collected and turned into actionable insights that get communicated clearly (and visually) to decision makers. All this requires powerful analytics tools that are more readily available today than ever. And those who can “harness data, advanced analytics, and behavioral science to make sound people and organization decisions faster, better, and with a level of specificity previously unavailable.”24

The talent wars are not won simply by outpacing the hiring competition. Talent cultivation and retention should be part of a larger business strategy, primarily because your people are the ones executing it. “The key is securing the capabilities needed to deliver that strategy.” Data should “quantify organizational skills deficits, target opportunities for re-skilling, and identify the skills to source externally.”25

Robust Data and Reporting Enhance People Strategies

The simple and familiar functionality of Excel or similar tools have their limitations when it comes to accuracy, updating, and translating large quantities of data into versatile reports. Strategic people management requires transparency and oversight into multiple areas, including comparing actual vs. planned hours, tracking different kinds of time (administrative, personal, travel, etc.), seeing every person’s utilization, and more. Valuable workflow data can reflect time spent on specific milestones, risk assessment tasks compared to project outcomes, people resource changes, etc.

With these insights, decision-makers are empowered to move or reassign resources quickly, adjust deadlines, manage budget changes, and adapt to many other contingencies, both expected and unexpected.

Tempus Resource enables leading businesses to plan for future needs. Competitive and visionary businesses formulate future resource needs in light of their strategic plans. Tempus includes strategy execution tooling along with industry leading what-if analysis features to identify resourcing needs over the near and long terms along with the tools, displays, and reports to clearly and visually communicate your organization’s skill, role, and competency shortfalls. With Tempus, you can easily quantify organizational skill deficits, identify opportunities for re-skilling, and identify the skills to source externally.

Test drive Tempus today and learn how hundreds of the world’s leading organizations plan their resources

Part 5

Conclusions

Strategy is only an idea without the right people, who can be hard to find and even harder to retain. But with the help of a people strategy, aligned directly with a larger business strategy, talent can not only be captured in the ultra-competitive Financial Services market, but also thrive in their work and contribute enormous business value. Beyond reducing costs or saving time, a people strategy promises to deliver better focus on customers with better trained and more productive people resources best fit for their roles. With the right people in place for the right work at the right time, changes and challenges, whether local or global, can be met with flexibility, insight, foresight, and, most importantly, resilience.

“Fostering the innovation and closer customer engagement needed to compete within this fast-changing landscape demands people with fresh ideas and a broad array of experiences and capabilities.”26

With Tempus Resource, you can achieve complete and total visibility into all aspects of your resource forecasting and capacity planning efforts. From business processes like resource request workflows and intelligence resource replacement to advanced supply-demand analysis and what-if analysis and scenario planning, Tempus provide the most comprehensive set of resource management functionality. Above all else, with Tempus, you can ensure your people strategy is aligned with your larger business strategy.

Contact ProSymmetry today for a free trial. We will train you and import your data for free!

Bibliography

1 “Ahead of the Curve: Confronting the Big Talent Challenges in Financial Services.” Ceosurvey.pwc.PricewaterhouseCoopers. Feb 2017. https://www.pwc.com/gx/en/ceo-survey/2017/industries/ceo-survey-fs-talent.pdf?logActivity=true

2 “Ahead of the Curve.”

3 Arellano, Carla et al. “Hidden Figures: The Quiet Power of Managing People Using Data.” Financial Services Insights. McKinsey & Company. 11 October 2018. https://www.mckinsey.com/industries/financial-services/our-insights/hidden-figures-the-quiet-discipline-of-managing-people-using-data#

4 “Ahead of the Curve.”

5 “Managing People Using Data.”

6 “Managing People Using Data.”

7 “Financial Services Sector Forced to Reconsider Talent Acquisition Strategies.” Workforce Insights. Randstad. 04 June 2020. https://www.randstad.com/workforce-insights/employer-branding/financial-services-sector-forced-to-reconsider-talent/

8 “Reconsider Talent Acquisition Strategies.”

9 “Managing People Using Data.”

10 “Human Resources Benchmark for Banks.” Deloitte Global Benchmarking Center. Deloitte Consulting LLP. 2012. https://www2.deloitte.com/content/dam/Deloitte/global/Documents/HumanCapital/dttl-hc-hrtbenchmarksbanks-8092013.pdf

11 “5 Pros and Cons of Unlimited PTO for Employers and Employees.” Smart Talk HR Blog. Randstad Risemart. 07 December 2018. https://www.randstadrisesmart.com/blog/5-pros-cons-unlimited-pto-employers-employees

12 “Managing People Using Data.”

13 Felton, Jane. “How the Gig Economy is Reshaping Talent Management in Financial Services.” Expert 360. https://expert360.com/resources/articles/talent-management-financial-services

14 “Reshaping Talent Management in Financial Services.”

15 “Reshaping Talent Management in Financial Services.”

16 “Reshaping Talent Management in Financial Services.”

17 Coleman, Hank. “Top 4 Ways Hiring a Freelance Saves Your Company Money. Money Q&A. https://moneyqanda.com/hiring-a-freelancer/

18 Frankel, Matthew. “The Biggest Mergers and Acquisitions in Banking. The Motley Fool. https://www.fool.com/investing/general/2015/04/22/the-biggest-mergers-and-acquisitions-in-banking.aspx

19 “Ahead of the Curve.”

20 “Ahead of the Curve.”

21 “Ahead of the Curve.”

22 “Ahead of the Curve.”

23 “Ahead of the Curve.”

24 “Managing People Using Data.”

25 “Managing People Using Data.”

26 “Managing People Using Data.”